📈 Investing Monthly in ETFs: A Smarter Way to Build Wealth

"Want to grow your money without picking stocks or stressing over the market? Investing monthly in ETFs is your answer."

Want to grow your money without picking stocks or stressing over the market?

Investing monthly in ETFs is one of the most powerful — and beginner-friendly — ways to build long-term wealth.

Let's break down why it works, what ETF to start with, and how to automate it with OneClick.

💡 Why Invest Monthly Instead of Occasionally?

Consistent monthly investing gives you 3 key advantages:

Dollar-Cost Averaging

You buy more shares when prices are low and fewer when prices are high — automatically reducing your average cost and risk over time.

Built-in Discipline

Investing becomes a habit, not a decision you have to revisit every month. This removes emotion and procrastination from the equation.

Compound Growth

Monthly contributions add up fast, especially when dividends and gains are reinvested automatically over years and decades.

"The magic isn't in the timing — it's in the consistency."

📊 Why ETFs Are Ideal for Monthly Investing

ETFs (Exchange-Traded Funds) are bundles of stocks that trade like individual stocks — but they're perfect for monthly investing because they're:

Diversified

One ETF can hold hundreds or thousands of stocks, spreading your risk automatically

Low-Cost

Most ETFs have expense ratios under 0.20%, meaning more of your money stays invested

Easy to Understand

No complex strategies or financial jargon — just buy and hold for the long term

Liquid

ETFs trade during market hours, so you can buy or sell anytime if needed

The most popular ETF for long-term investors is SPY, which tracks the S&P 500 — 500 of the largest U.S. companies.

By investing in SPY monthly, you get exposure to:

- • Apple

- • Microsoft

- • Amazon

- • Google/Alphabet

- • Tesla

- • Meta/Facebook

- • NVIDIA

- • And 493 more companies

All in one fund.

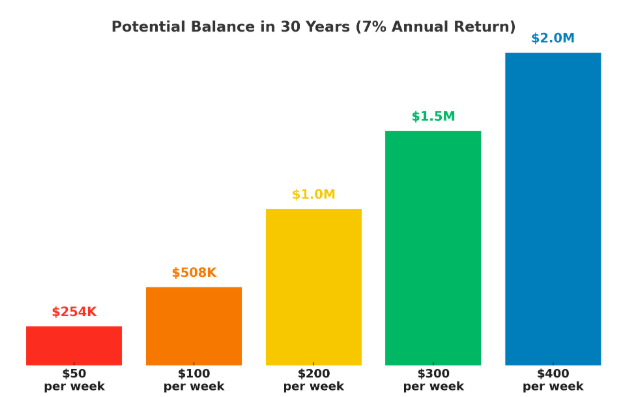

📈 The Power of Monthly ETF Investing

Let's look at what happens when you invest a consistent amount monthly into SPY:

| Monthly Amount | 5 Years | 10 Years | 30 Years |

|---|---|---|---|

| $50 | ~$3,600 | ~$8,000 | ~$82,000 |

| $100 | ~$7,200 | ~$16,000 | ~$165,000 |

| $250 | ~$18,000 | ~$40,000 | ~$412,000 |

💡 Key insight: The earlier and more consistently you start, the more powerful the results. Time is your biggest advantage.

🚀 How OneClick Makes It Automatic

OneClick Investing is designed specifically for monthly ETF investing — with zero guesswork.

Here's how it works:

- 1.Connect your bank account (secure, encrypted connection)

- 2.We analyze your income and expenses

- 3.We recommend a monthly plan (e.g. $100/month into SPY)

- 4.You confirm the amount and schedule

- 5.We automatically invest in SPY every month — no action needed

No Stock Picking

We invest in SPY automatically

No Rebalancing

SPY is already perfectly balanced

No Effort Required

Just consistent, passive wealth-building

Just consistent, passive wealth-building on complete autopilot.

🤔 Monthly vs Lump Sum: Which Is Better?

✅ Monthly Investing

- • Reduces timing risk through dollar-cost averaging

- • Easier to budget and maintain

- • Builds consistent investing habits

- • Less stressful than trying to time the market

- • Works with any income level

⚠️ Lump Sum Investing

- • Requires large amounts of cash upfront

- • Higher timing risk (what if you buy at the peak?)

- • Can be emotionally difficult

- • Not practical for most people

- • Easy to procrastinate and never start

For most people, monthly investing is the smarter, more sustainable approach.

💰 Real-World Example: Sarah's Monthly ETF Journey

Meet Sarah, 28, Marketing Manager

Starting point: $500 in savings, $3,000/month income

OneClick recommendation: $150/month into SPY

After 5 years: ~$10,800 (from $9,000 invested)

After 10 years: ~$24,000 (from $18,000 invested)

After 30 years: ~$248,000 (from $54,000 invested)

Sarah never had to pick stocks, time the market, or stress about her investments. She just set up her plan once and let it run automatically.

🎯 Tips for Successful Monthly ETF Investing

Start with what you can afford

Even $25/month is better than waiting until you can afford $200/month

Increase your amount over time

Got a raise? Bump up your monthly investment to accelerate your wealth building

Stay consistent

Don't skip months or try to time the market — consistency is your biggest advantage

Think long-term

Monthly ETF investing works best over 5+ years — don't panic during short-term market dips

🧠 Final Thoughts

If you're serious about building long-term wealth without daily decision fatigue, investing monthly in ETFs is your strategy.

Monthly ETF investing is:

Especially with OneClick automating the entire process for you.

Start investing in ETFs like SPY automatically every month — and watch your wealth grow on autopilot.

Begin your automated monthly ETF investing journey with OneClick — just a few taps to get started.