📊 Investing Without Picking Stocks: A Simple Strategy That Works

"Not sure which stocks to buy? Don't want to spend hours researching? You don't have to. Here's a smarter way to invest."

Not sure which stocks to buy?

Don't want to spend hours researching the market?

You're not alone — and you don't have to.

There's a smarter, simpler way to invest without ever picking individual stocks. It's called passive ETF investing, and it's how millions build long-term wealth.

🤔 Why People Want to Avoid Picking Stocks

Picking stocks can be:

❌ The Problems with Stock Picking

- • Time-consuming research required

- • Stressful decision-making

- • High risk of picking losers

- • Emotional ups and downs

- • Requires financial expertise

✅ The ETF Alternative

- • No research needed

- • Built-in diversification

- • Lower risk through spreading

- • Set-and-forget simplicity

- • Perfect for beginners

Most importantly: Very few people actually beat the market by picking individual stocks.

💡 The Alternative: Buy the Whole Market

Instead of trying to pick winners, you can invest in ETFs (Exchange-Traded Funds) that track entire indexes like the S&P 500.

The most popular ETF is SPY — and it gives you:

- Instant diversification across 500 companies

- Exposure to the top U.S. companies

- A long-term track record of growth

- Low fees (0.09% expense ratio)

When you buy SPY, you own a piece of Apple, Microsoft, Amazon, Google, and 496 other top companies — all in one purchase.

🧠 The Benefits of Investing Without Picking Stocks

By using ETFs like SPY, you get:

Built-in Diversification

Your risk is spread across hundreds of companies, so one bad performer won't tank your portfolio

No Stock Analysis Needed

No need to read financial statements, follow earnings reports, or analyze company fundamentals

Lower Fees

ETFs typically have much lower fees than actively managed funds or frequent trading

Less Stress

No worrying about individual company news, scandals, or earnings misses

"You're not gambling. You're building wealth the boring (but proven) way."

📊 Stock Picking vs ETF Investing: The Numbers

| Approach | Time Required | Success Rate | Stress Level |

|---|---|---|---|

| Individual Stock Picking | Hours weekly | ~20% | High |

| ETF Investing (SPY) | 5 minutes/month | ~90% | Low |

| Day Trading | Hours daily | ~5% | Very High |

🚀 How OneClick Makes It Automatic

OneClick is an investing app built for people who don't want to think about investing.

Here's how it works:

- 1.Link your bank account

- 2.We analyze your income and expenses

- 3.We recommend an automatic monthly investment (e.g. $100/month)

- 4.You confirm — and we invest it in SPY, every month, automatically

No Stock Picks

We invest in SPY automatically

No Trading

Just consistent, long-term investing

No Financial Jargon

Simple dashboard, real results

Just one simple plan — that runs on autopilot.

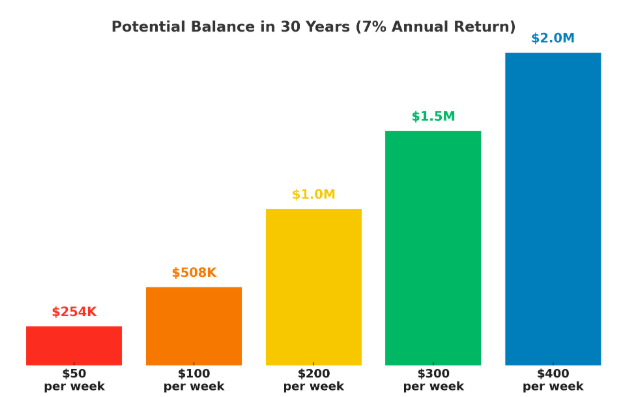

📈 Long-Term Potential Without Stock Picking

If you invest $100/month into SPY with average returns of 7%:

| Time Period | Monthly Investment | Approx. Value |

|---|---|---|

| 5 years | $100 | ~$7,200 |

| 10 years | $100 | ~$16,000 |

| 30 years | $100 | $165,000+ |

The key? Consistency. Not complexity.

🤔 What About Missing Out on Big Winners?

"But what if I miss the next Apple or Tesla?" you might ask.

Here's the reality:

- • For every Apple, there are dozens of failed companies

- • Even professional fund managers struggle to pick winners consistently

- • When you own SPY, you automatically own the winners as they grow

- • You also avoid the losers that can wipe out your portfolio

Remember: SPY automatically includes companies like Apple and Tesla as they become successful. You get the winners without having to predict them in advance.

🧠 Final Thoughts

You don't need to pick the next Amazon or guess when the market will dip.

You just need a plan — and a system that sticks to it.

Investing without picking stocks means:

That's what OneClick delivers.

Start investing without the guesswork — and let your money grow in the background.

Start building wealth automatically — no stock research required.